tax abatement nyc meaning

Perhaps the most well-known is the 421a abatement which recently expired but gave developers and. Everybody still with.

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

A J-51 abatement is a form of tax exemption that freezes the assessed value of your structure at the level before you started.

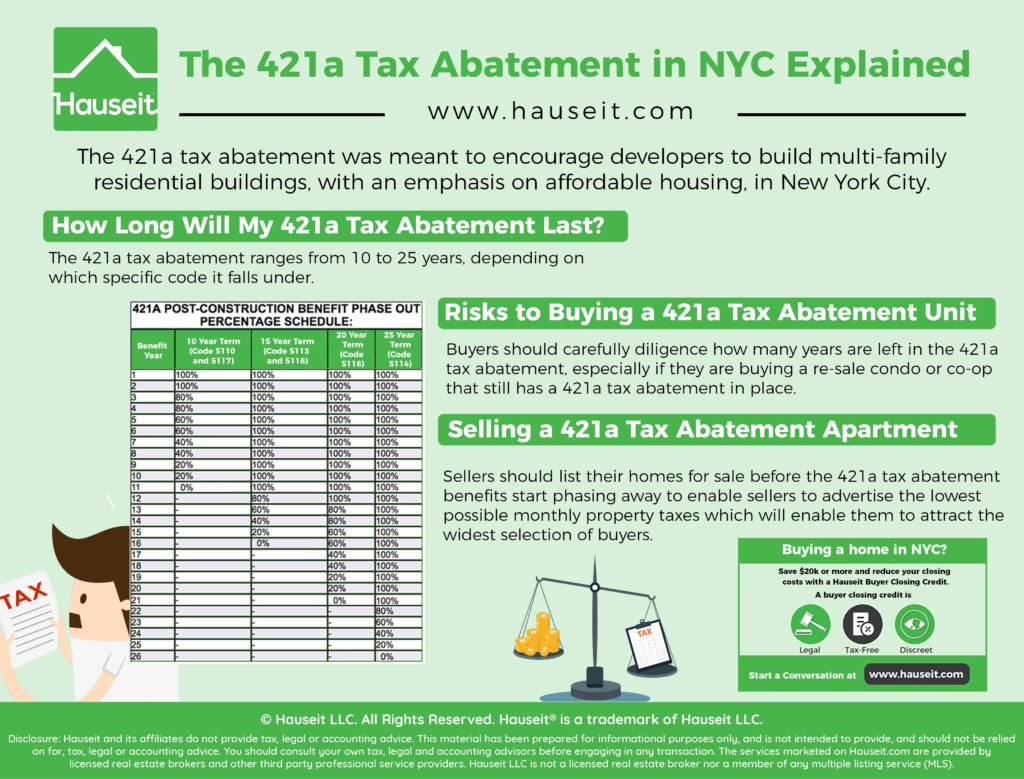

. There are multiple variations of the 421a tax abatement ranging from terms of 10 to 25 years. For one there are many different types of abatements given to buildings for different reasons. The reduction percentage is between 175 and 281 if the owners meet certain requirements to apply for the abatement.

The agreement details how the local government will reduce property taxes for an improvement an individual performs to a home or development a company contributes to the local economy. The 421a tax exemption program encourages the development of underutilized or vacant property by dramatically reducing taxes for developers and end-users for a set period whereas the 421g tax incentive program is a tax exemption and abatement for the conversion of commercial buildings or portions of buildings into multiple dwellings. During the time period thousands of New Yorkers were moving upstate or to the suburbs and City officials feared a decline in residential development.

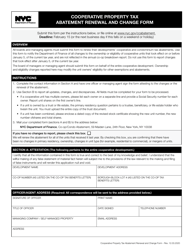

One of those perplexing terms is 421a tax abatement. ICAP replaced the Industrial Commercial Exemption Program ICIP which ended in. Co-op and condo boards and managing agents must notify the Department of Finance of changes in ownership or eligibility for the Cooperative and Condominium Property Tax Abatement by February 15 or the following business day if.

If youre shopping around for a co-op or condo in NYC youre bound to encounter some real estate jargon in listings. If a new building is constructed or an old building is fully rehabilitated the owner can receive an abatementexemption from real estate taxes for a prescribed period from the City. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area.

The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York. Put simply a tax abatement is exactly what it sounds like. Co-op and condo unit owners may be eligible for a property tax abatement.

The second-highest tax break an abatement for coops and condos cost 655 million last year. Cons of 421a tax abatements for nyc home buyers. In return for this tax benefit the building is placed under rent stabilization.

Industrial Commercial Abatement Program ICAP The 2022-2023 renewal period has ended. A break on a building or apartments property taxes. Tax abatement nyc meaning.

While 421a tax abatements get all the attention there are actually many other types offered by NYC. A co-op tax abatement assessment allows a co-op to raise additional revenue for ongoing building operations and capital improvements by capturing tax abatement or tax exemption proceeds paid to the co-op corporation by the city of New York instead of returning this money to shareholders. More than half or 56 of all the citys multifamily residential units created in the past eight years involved 421-a according to Housing Preservation and Development data analyzed by the Real Estate Board of New York.

This program provides abatements for property taxes for periods of up to 25 years. Usually the tax break goes with the property as long as the project continues to qualify. The tax abatement was meant to encourage developers to build multi-family residential buildings with an emphasis on affordable housing in New York City.

The short answer is likely going to sting so lets rip this bandage off early. Abatements reduce your taxes after theyve been calculated by applying dollar credits to the amount of taxes owed. To be eligible industrial and commercial buildings must be built modernized expanded or otherwise physically improved.

Of course in practice its a little more complicated than that. The exemption also applies to buildings that add new residential units. Building management boards of directors or other official representatives must apply for the co-op or condo abatement on behalf of the eligible building units.

The NYC cooperative and condominium tax abatement commonly referred to as the co-op and condo tax abatement for short allows the owners of a co-op or condo in NYC to have their property taxes reduced. In essence its a tax exemption program given to building developers that typically lowers the property taxes for residential units for some time. Homebuyers can understand the true meaning of the abatement by knowing when it will expire.

In NYC 421-a tax abatements were introduced in 1971 and were implemented to encourage developers to develop unused and underutilized land by offering them reduced property taxes for a set amount of time typically between 10-25 years. The most important abatement is arguably the Cooperative and Condominium Property Tax Abatement which reduces property taxes for apartment owners all over the city. To be eligible for this benefit you must have renovated your structure or plan to convert an industrial or commercial structure into a residential building.

Abatements can last anywhere from just a few months to multiple years at a time. If you are curious you can find the entire collection here. Since the 1970s New York City has offered 421-A tax abatements--meaning temporary tax reductions--as an incentive for developers to build affordable housing either as part of the new development theyre building or in a separate project within the same districtAs such many newly constructed buildings offer abatements for varying lengths.

The 421-a tax abatement was created in 1971 to encourage the development of underutilized or unused land by significantly reducing property taxes on newly developed land for a set period of time. The J-51 tax abatement is an exclusive tax benefit given to some building owners. In short a tax abatement is when the government grants a reduction or exemption from taxes for a specific period in order to stimulate real estate or industrial development.

The NYC cooperative and condominium tax abatement commonly referred to as the co-op and condo tax abatement for short allows the owners of a co-op or condo in NYC to have their property taxes reduced. What Is The 421a Tax Abatement NYC.

Computer Rendering Of The Infinity Pool That Will Sit Atop Brooklyn Tower Pool Rooftop Pool Infinity Pool

What Is The 421g Tax Abatement In Nyc Hauseit

The 421a Tax Abatement In Nyc Explained Hauseit

What Are The Tax Abatements For Coops And Condos In Nyc Propertynest

What Is A 421a Tax Abatement In Nyc Streeteasy

The Real Reasons Your Home Is Not Selling Buying A Condo Reasons Building Management

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

How Much Is The Coop Condo Tax Abatement In Nyc

The 421a Tax Abatement In Nyc Explained Hauseit

Cheapest Ways To Sell A House Hauseit Things To Sell Selling Strategies Selling House

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

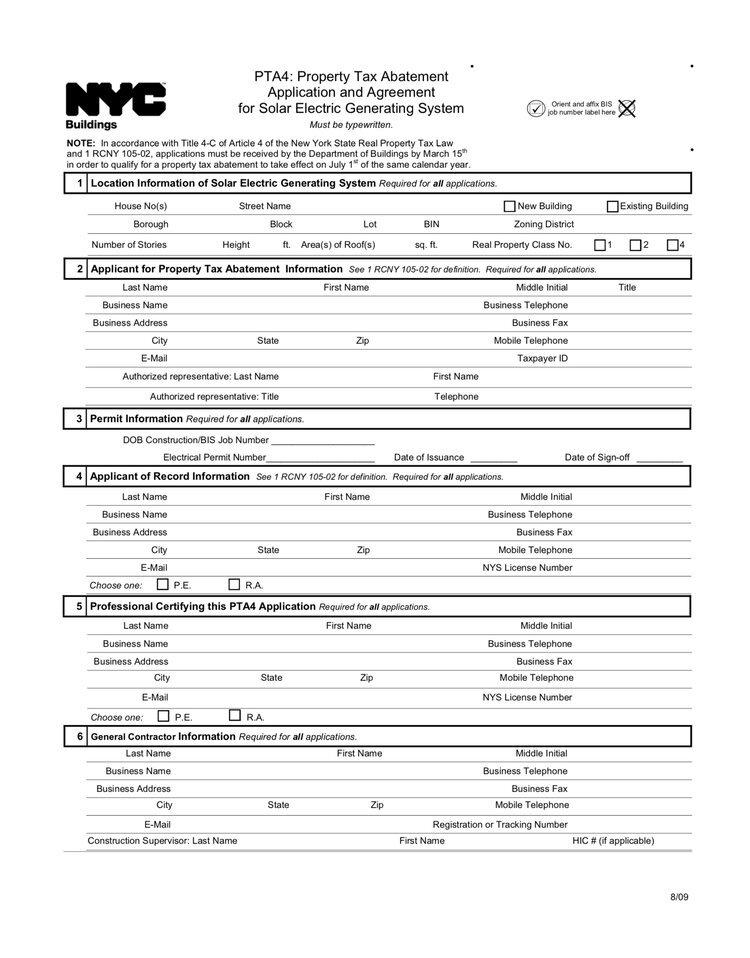

Nyc Solar Property Tax Abatement Pta4 Explained 2022

What Is The 421g Tax Abatement In Nyc Hauseit

Nyc 421a Tax Abatements What Are They And How To Verify Yoreevo Yoreevo

How To Calculate The Unabated Property Taxes On A Nyc Condo With A 421a Tax Abatement Youtube

New York City Cooperative Property Tax Abatement Renewal And Change Form Download Fillable Pdf Templateroller