philadelphia property tax rate 2022

Philadelphia County is located in Pennsylvania. It also boasts the third-lowest average property tax rates in the state according to the Tax Foundation.

Philadelphia Property Assessments For 2023 Tax Year What To Know

The budgettax rate-determining process usually includes customary public hearings to discuss tax concerns and related budgetary considerations.

. Tax Year 2022 assessments will be certified by OPA by March 31 2021. 1 day agoAt a moment of fraught debate and a high-profile lawsuit about how well and equitably Pennsylvania funds its public schools Mastriano actually believes taxpayer spending. Property taxes Philadelphia property owners are getting new assessments.

May 9 2022 Highlights Housing Philadelphia released new assessments of property values which they will use to calculate 2023 property tax bills. May 13 2022. Find more information about Philadelphia Real Estate Tax including information about discount and.

The OPA didnt conduct new property reassessments for fiscal year 2021. 06317 City 07681 School District 13998 Total The amount of Real Estate Tax you owe is determined by the value of your. 350 tax rate for nonresidents who work in Philadelphia Residents of Philadelphia pay a flat city income tax of 393 on earned income in addition to the Pennsylvania income tax and the.

Appeal a property assessment Due dates and instructions. Only owners of properties with new construction or expiring tax breaks will receive new assessments this year. According to a more.

Currently the Philadelphia property tax rate is 13998 and the Homestead Exemption is 45000. May 03 2022 As Philly braces for property value reassessments Kenney proposes wage tax reduction and other relief The real estate boom has increased the. The citys property tax rate is 13998 of the assessed property value.

For the 2022 tax year the rates are. To get an estimate of your annual property tax bill you can use a regular calculator to determine 13998 the citys current real estate tax rate of your current assessed value. At the end of the year these charges begin to accrue interest and penalties.

Currently the Philadelphia property tax rate is 13998 and the Homestead Exemption is 45000. If you havent paid your 2022 Philadelphia property tax make sure you do so by March 31. Philadelphia released new property tax reassessments after a two-year hiatus Tuesday showing citywide values skyrocketing by 21 on average.

The coronavirus pandemic disrupted the citys ability to conduct citywide property assessments for tax year 2022 leading officials to delay the reassessment for another year. If your assessed value. Philadelphia County Property Tax Rate 2022 Go To Different County Lowest Property Tax Highest Property Tax No Tax Data Philadelphia County Pennsylvania Property Tax Go To.

Property taxes Tax information for owners of property located in Philadelphia including tax rates due dates and applicable discounts. In 2020 youll see that the land is valued at 30315 and the improvements. What you should know On average those tax assessments are going up 31 from this years.

Property Tax in Philadelphia PA 2022 Guide Rates Due Date Exemptions Calculator Records Codes Ultimate Philadelphia Real Property Tax Guide for 2022 Guide Overview Average Rates. The citys revaluation that took effect in 2019 saw a 105. Since the city posted new real estate assessments online Monday many Philadelphia property owners have reacted with shock or skepticism about their.

The City calculates your taxes using these numbers but can change. For tax year 2020 the value of a median single-family home rose by more than 3. Be aware that under state law taxpayers.

PHILADELPHIA The City of Philadelphia announced today that due to operational concerns caused by the COVID-19 pandemic it will forgo a citywide reassessment. If you disagree with your property. Missing this deadline will add additional costs to your account balance including.

Philly Property Reassessments Mayor Kenney Proposes Wage Tax Reductions Other Relief Efforts To Counter Spikes In Value Phillyvoice

Milford Tax Rates To Drop In 2022 But Values May Boost Bills Milford Ma Patch

Philly City Council Considers Relief For Property Taxes Whyy

Philadelphia Looks To Reduce City Wage Tax To Offset Rising Property Tax Burden Philadelphia Business Journal

Which Pa Counties Have The Lowest Tax Burden The Numbers Racket Pennsylvania Capital Star

/cloudfront-us-east-1.images.arcpublishing.com/pmn/TRE43SIKIVB5DMPGVY7BZAR3HA.jpg)

Philly Property Assessments Double In Some Neighborhoods For 2023 Tax Year

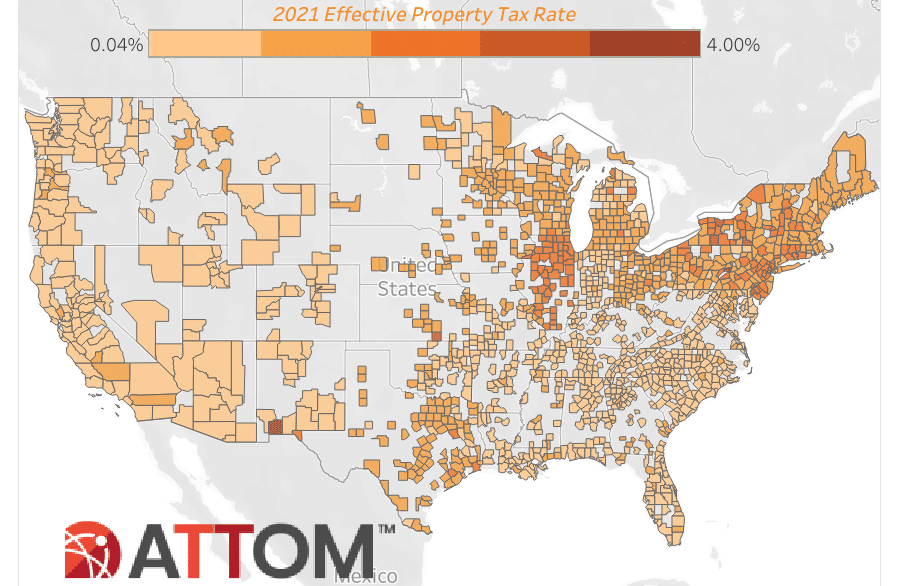

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Philadelphia Releases New Property Tax Amounts Estimate Your New Tax Bill Here

Sparing Philadelphia Homeowners From Increasing Property Tax Burdens

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

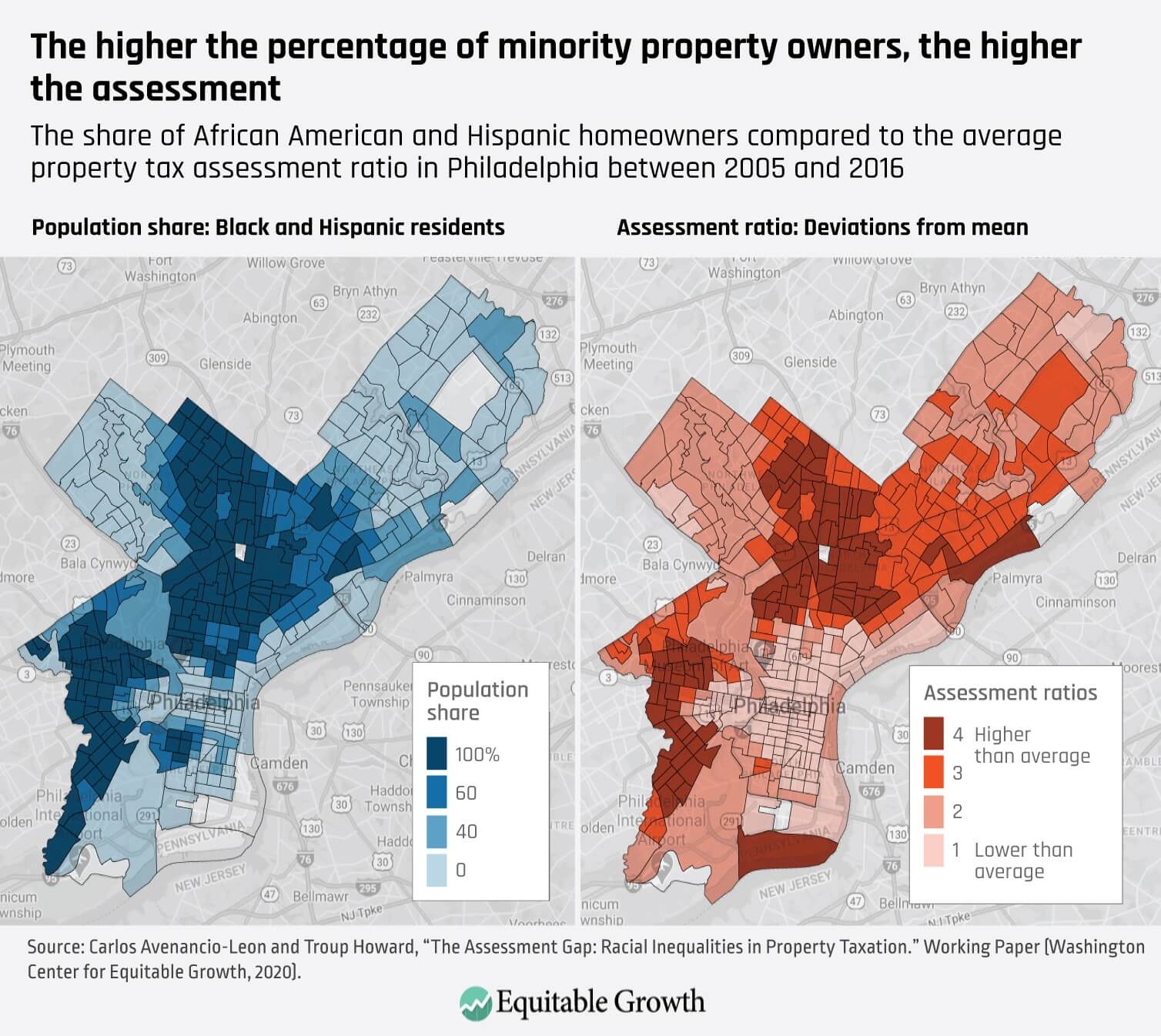

Misvaluations In Local Property Tax Assessments Cause The Tax Burden To Fall More Heavily On Black Latinx Homeowners Equitable Growth

This Map Makes It Easy To Compare Your Property Tax Change To Your Neighbors On Top Of Philly News

How A Philadelphia Property Tax Issue Nearly Cost Us Our House

Socked By The Pandemic Kenney Administration Forgoes Property Reassessments For Second Year In A Row Pennsylvania Capital Star

Handle With Care 2022 Property Tax Bills Department Of Revenue City Of Philadelphia

Philly Wage Tax To Be Lowered In New City Proposal Whyy

Philadelphia Wage And Earnings Taxes Decrease On July 1 Department Of Revenue City Of Philadelphia

/cloudfront-us-east-1.images.arcpublishing.com/pmn/AOSJXQVTCVHSPMOI75C4M4MFM4.jpg)